ICE Mortgage • Financial • Admin Tool

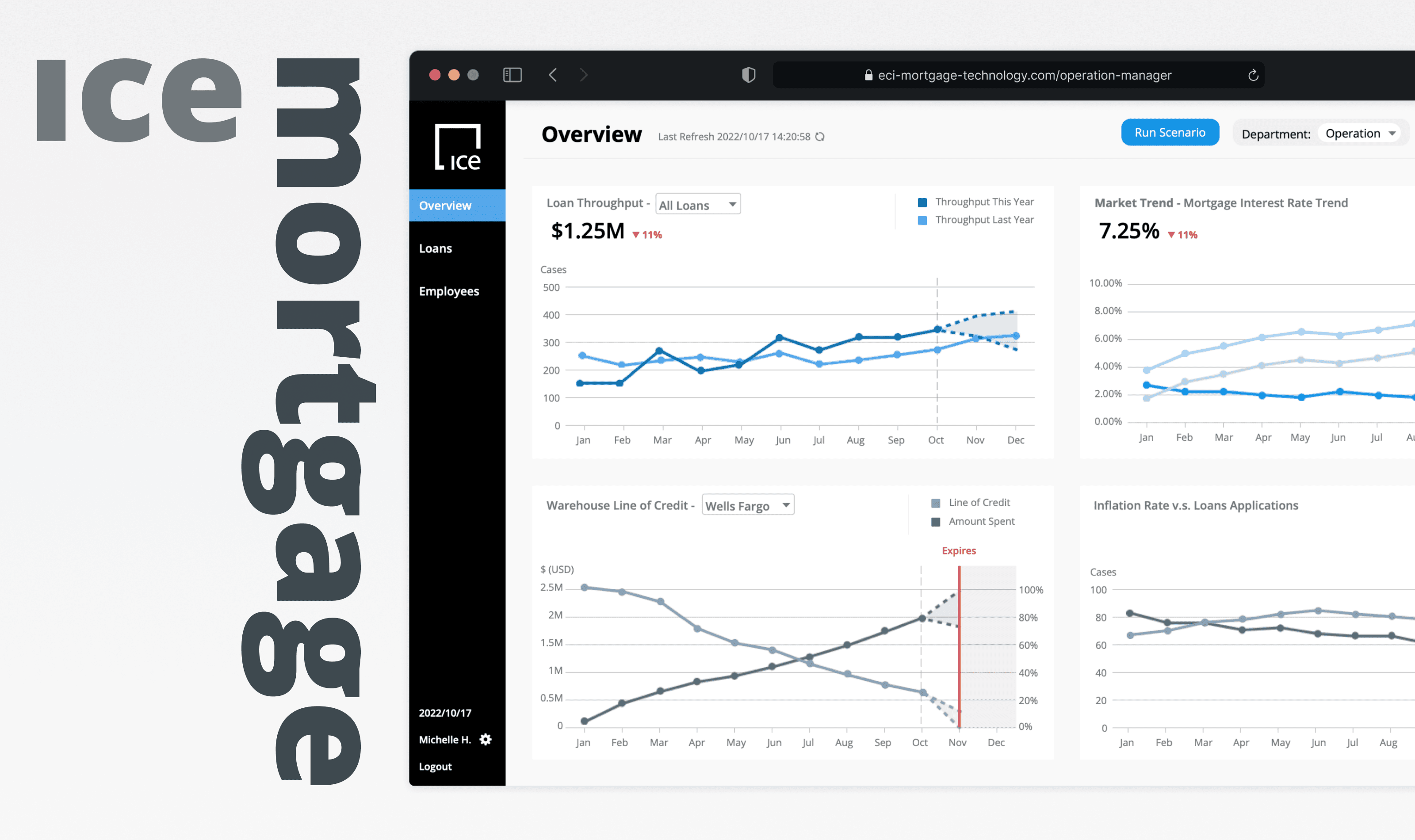

Increasing loan throughput with an action-ready data-driven dashboard

Objective

The project was to design a two-viewed dashboard that visualized complex mortgage data, prioritized and addressed different user pain points to increase loan throughput.

Team

Individual

Client (Stakeholder)

Role

UX Design,

Data Visualization

Tools

Figma

Axure RP

Timeline

6 Weeks,

Fall 2022

Outcome

Positive comments and feedback from stakeholders

ICE Mortgage Stakeholder

Visually very appealing and use of color, charts, etc. It's clean which makes it easy on the eye. Good understanding of process.

Professor D. Rosenberg

This is a very elegant design and clearly thought through regarding the needs of each persona. The overall foundation and IA are solid and well implemented.

Background

What is the project about?

This project was a sponsored academic project partnered with ICE Mortgage, a company focusing on cloud-based mortgage services.

In this project, ICE Mortgage wants to support their customers (banks) in improving efficiency across the loan processing time and increase loan throughput.

Problems

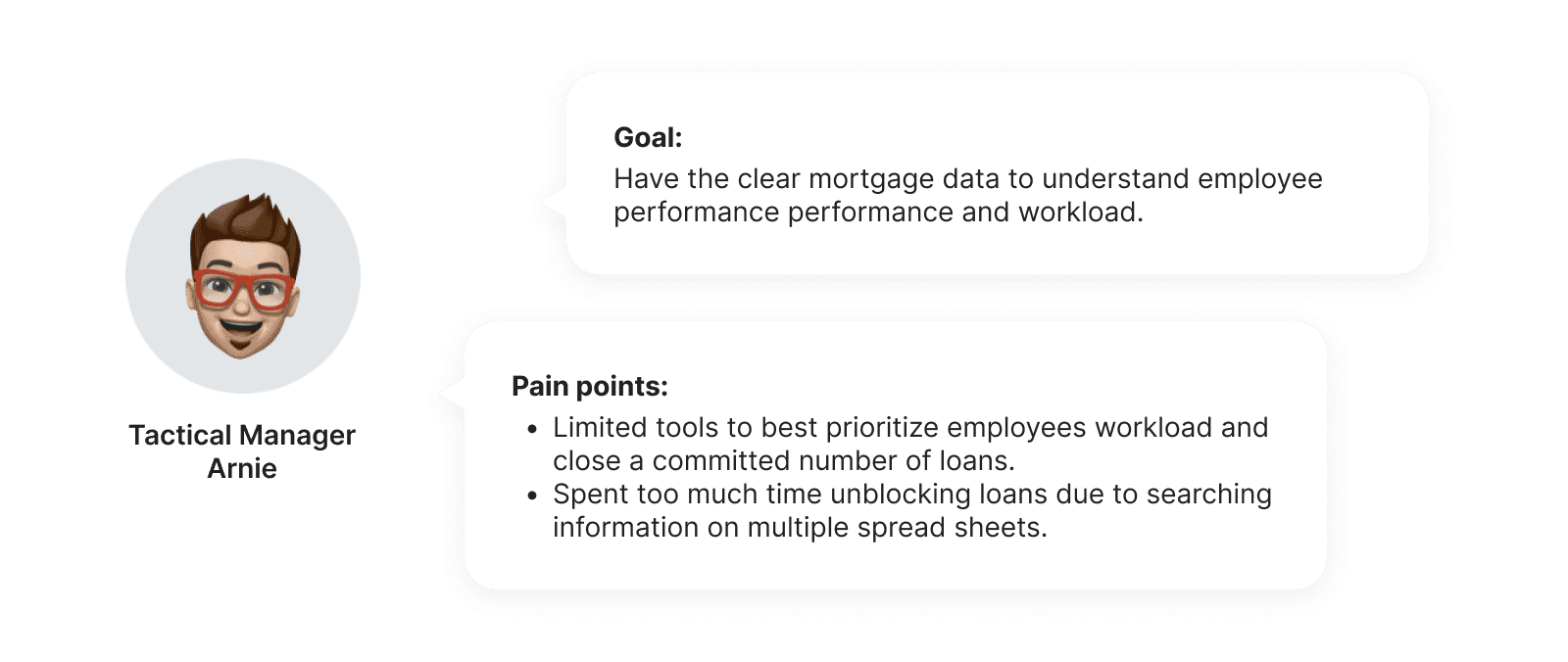

Problem 1: Difficult to manage officers' capabilities

Tactical managers encountered challenges to easily oversee staff production and re-assign works effectively for closing committed loans in time.

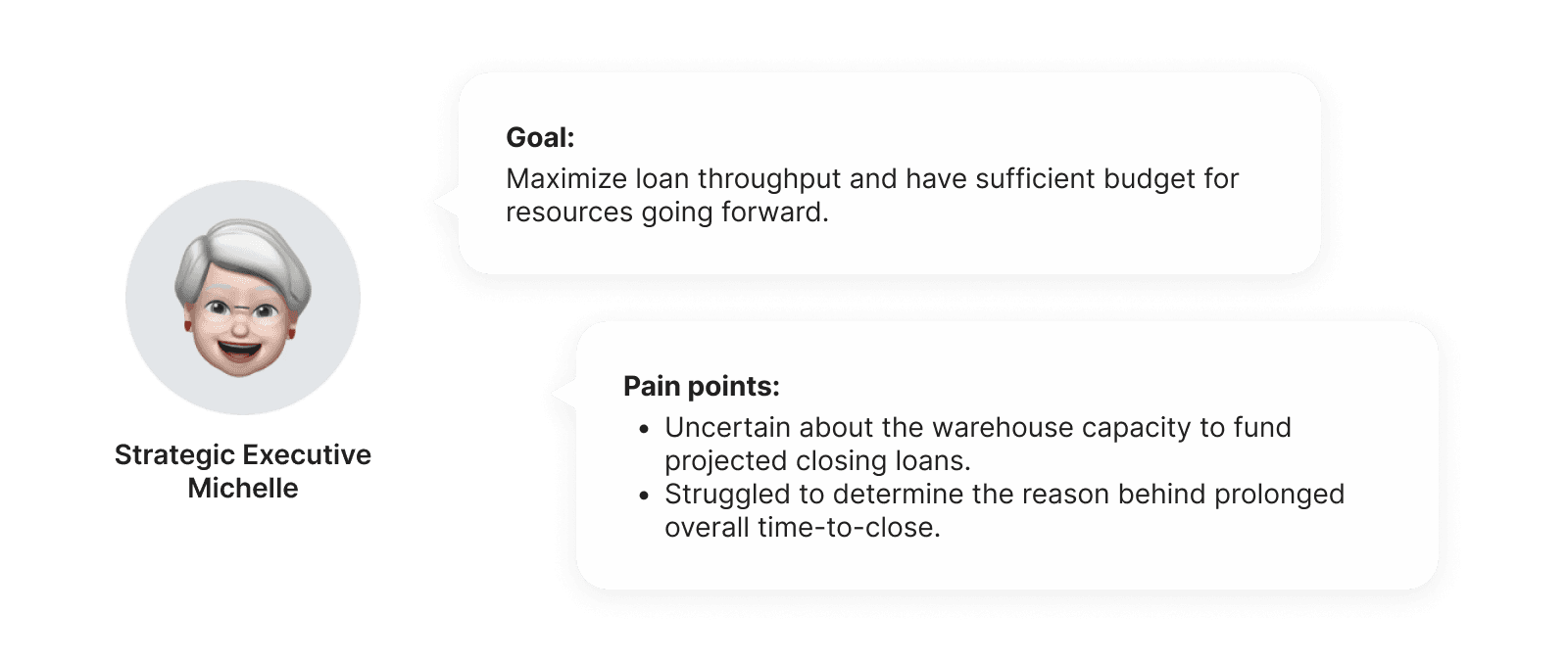

Problem 2: Challenge to forecast potential delay factors

Strategic level executives faced challenges to anticipate potential delays and therefore demanding a streamlined process to quickly identify critical factors influencing loan closing time.

Key insights

One dashboard → Two layout views

In order to tackle the above mentioned problems, I decided to integrate a dashboard with two different layout views to cater to the needs of both critical user groups.

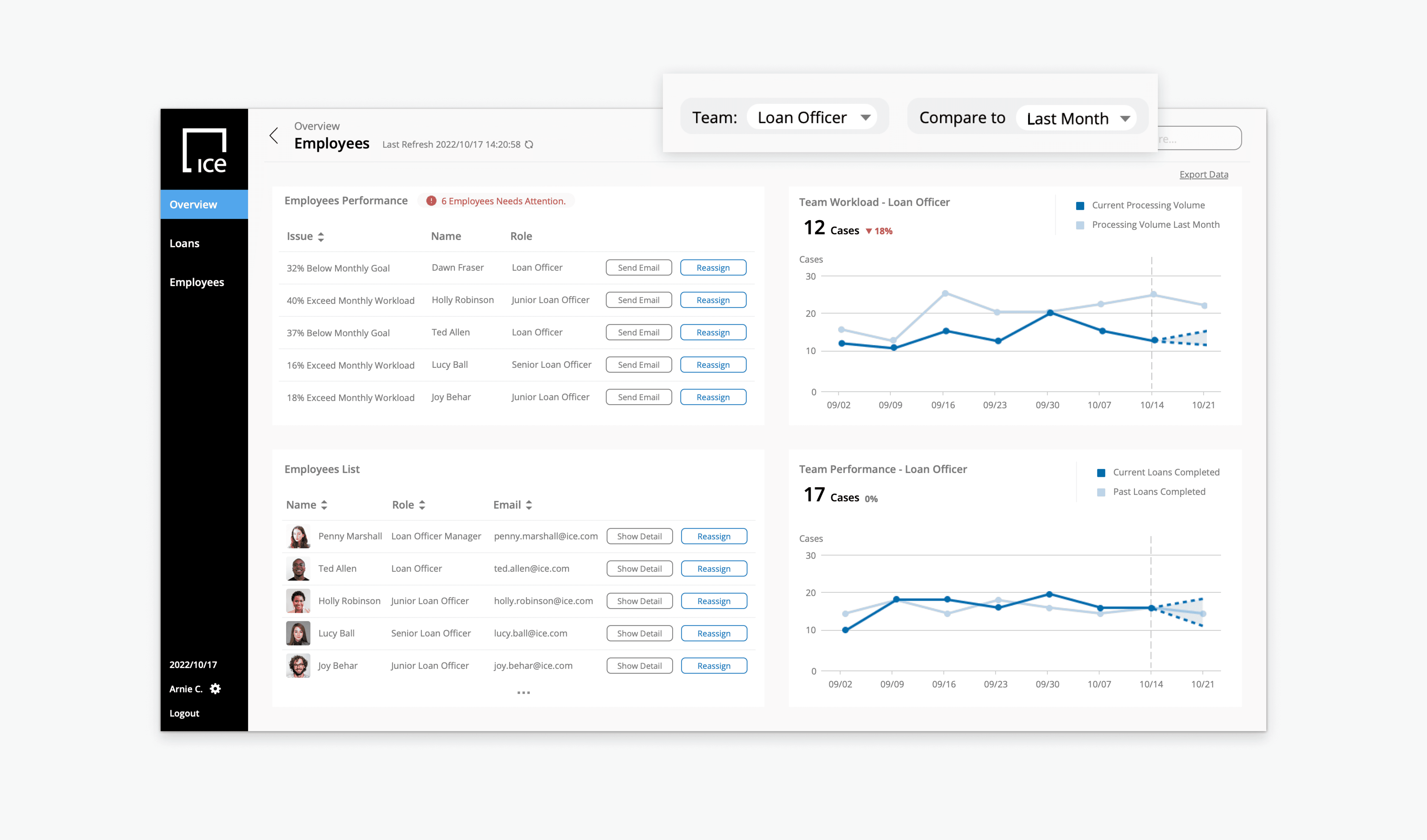

Manager View

Overviewing employee workload and performance, ensuring a streamlined loan processing flow.

Executive View

Overviewing closing loans and forecast warehouse capacity to ensure adequate funding.

Design Goal

How can we organize complex loan data into an action-ready dashboard?

The absence of a high-level tool to comprehensively oversee data and staff performance was identified during problem discovery. Difficulties arises when optimizing staff workloads and foreseeing warehouse capacity, leading a decrease in loan throughput.

Conceptualization

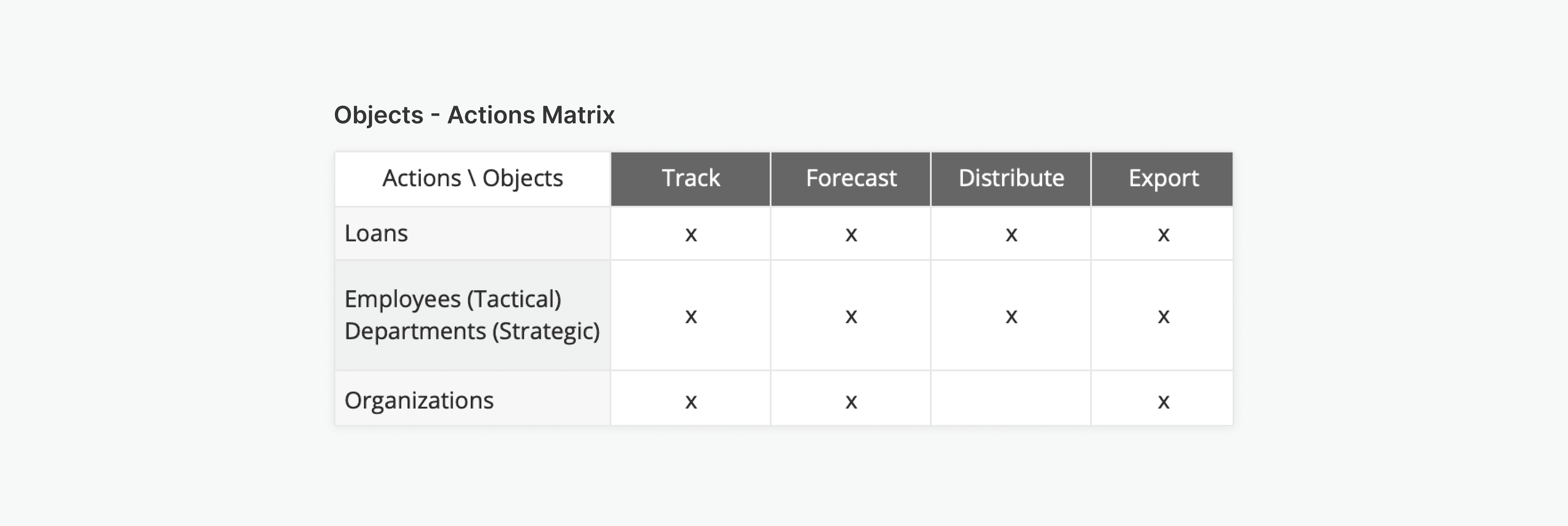

Conceptualizing the dashboard information hierarchy to optimize user cognitive load

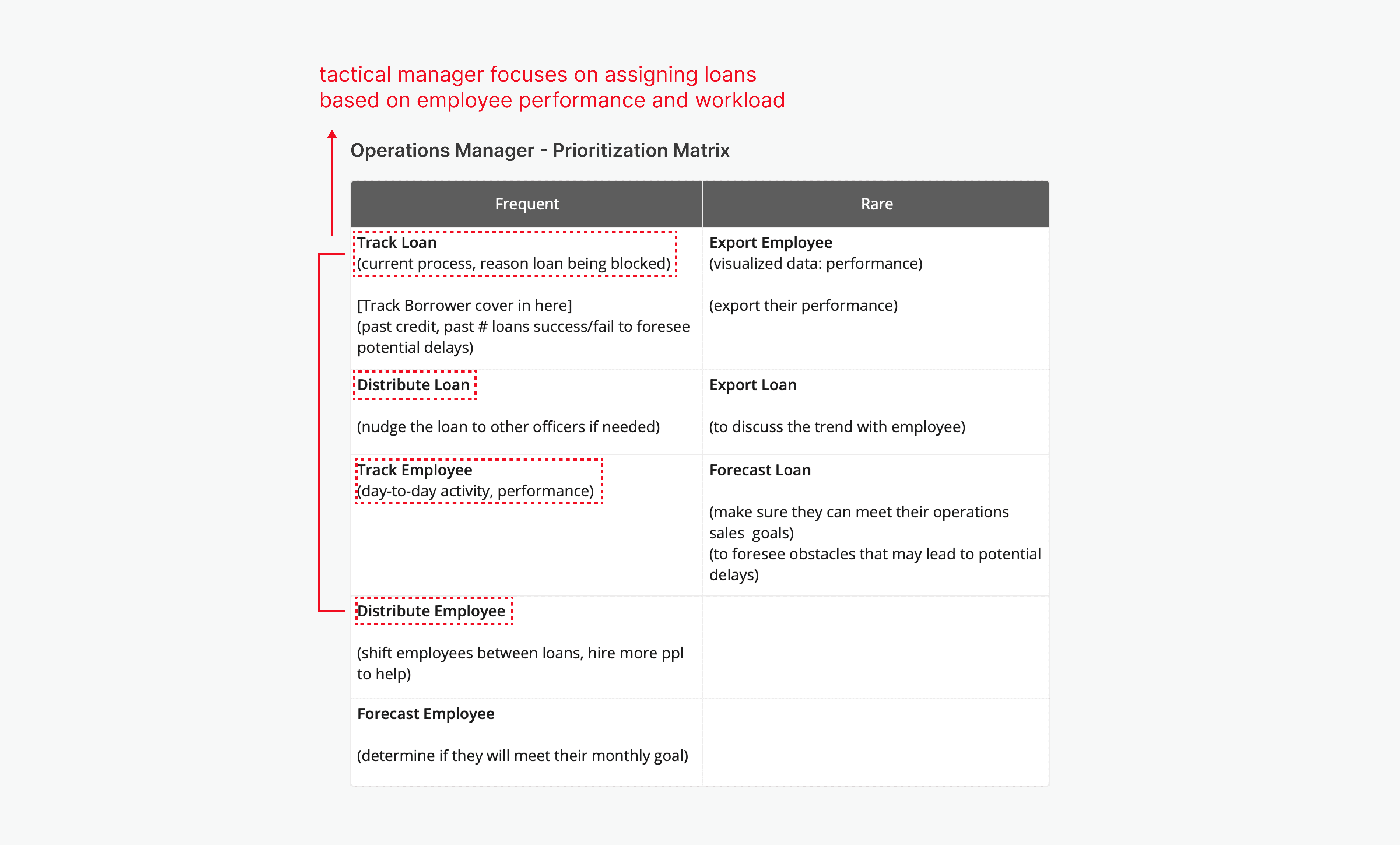

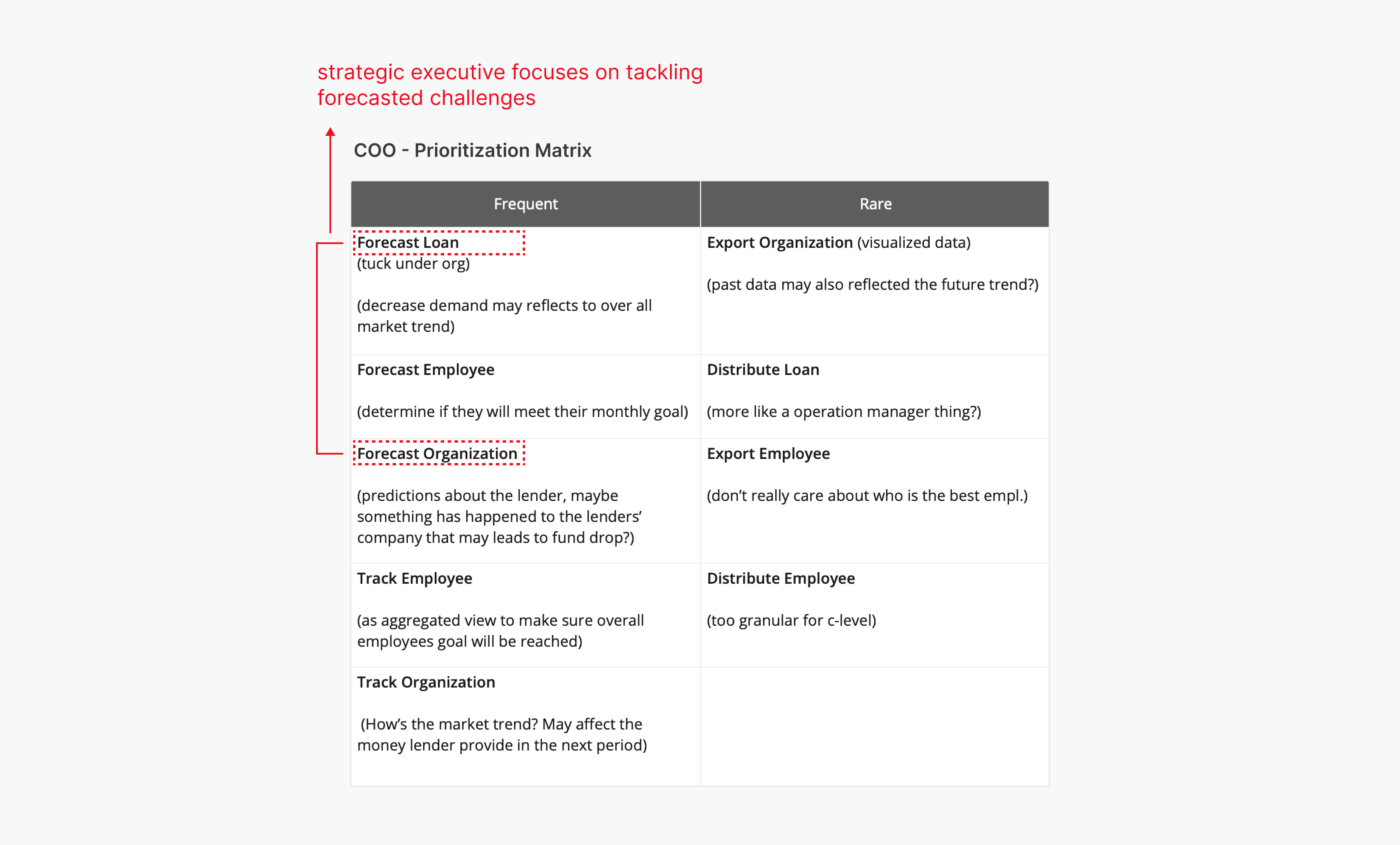

After identifying the major jobs to be done, they were transformed into a matrix using actions and objects. This ensures a clear information hierarchy, optimizing user cognitive load.

Jobs-to-be-done

Defining jobs-to-be-done based on the priority focuses

Based on the conceptualization insights, aspects of jobs-to-be-done were defined and taken into consideration.

Employees 👤

Time takes to process a loan

Number of loans processed

Return of Investments

Loans 💰

Loan processing cycle-time

Number of loans processed

Profit generated per loan

Organizations 🏛️

Target numbers to close loans

Warehouse fund and capacity

Amount of income earned

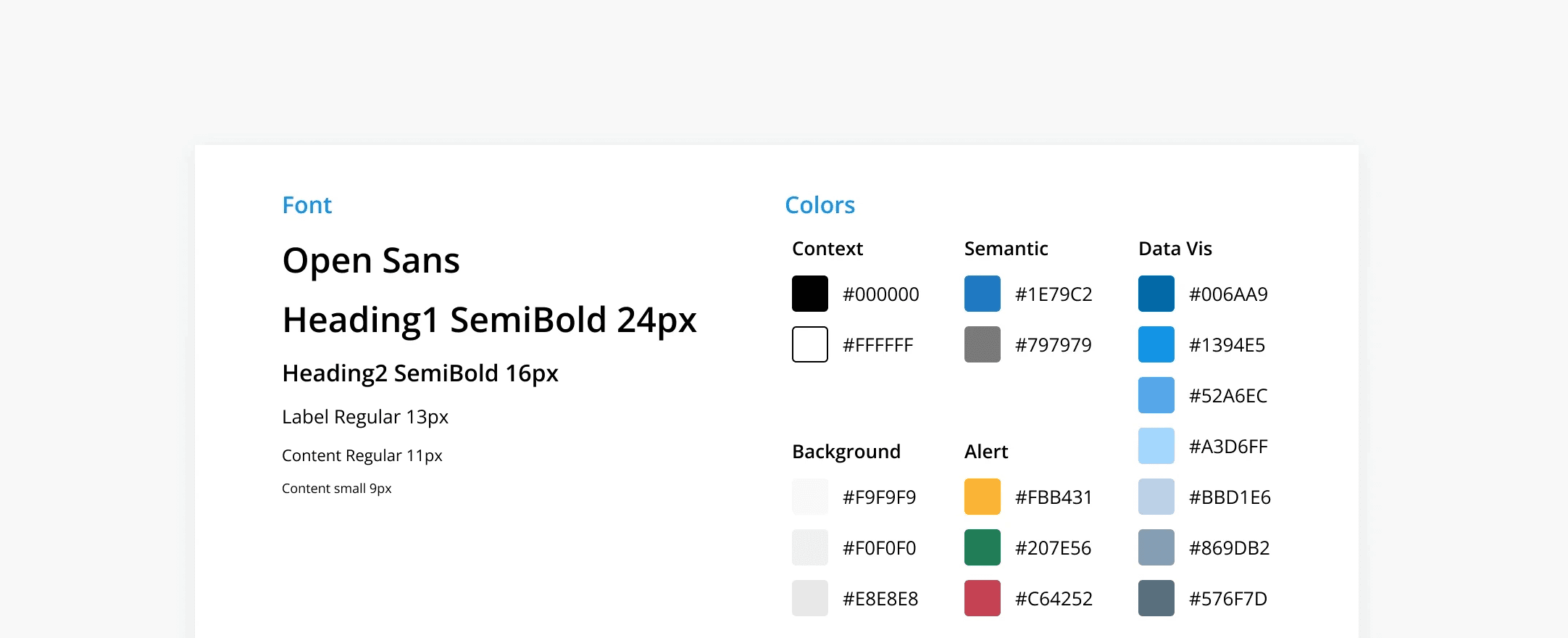

Design System

Establishing an action-oriented and trustworthy platform.

I chose blue as the semantic color and overall color theme for data visualization design because blue to align with ICE Mortgage’s brand color, moreover, color blue generally gives users a sense of trust, reliability, and professionalism which fits perfectly within the mortgage industry.

Brand Voice: Trustworthy and Professional

ICE Mortgage is all about mortgages and loans. To align with the company vision, I designed the brand voice to convey a sense of trust and professionalism, letting consumers feel reliable about applying loans.

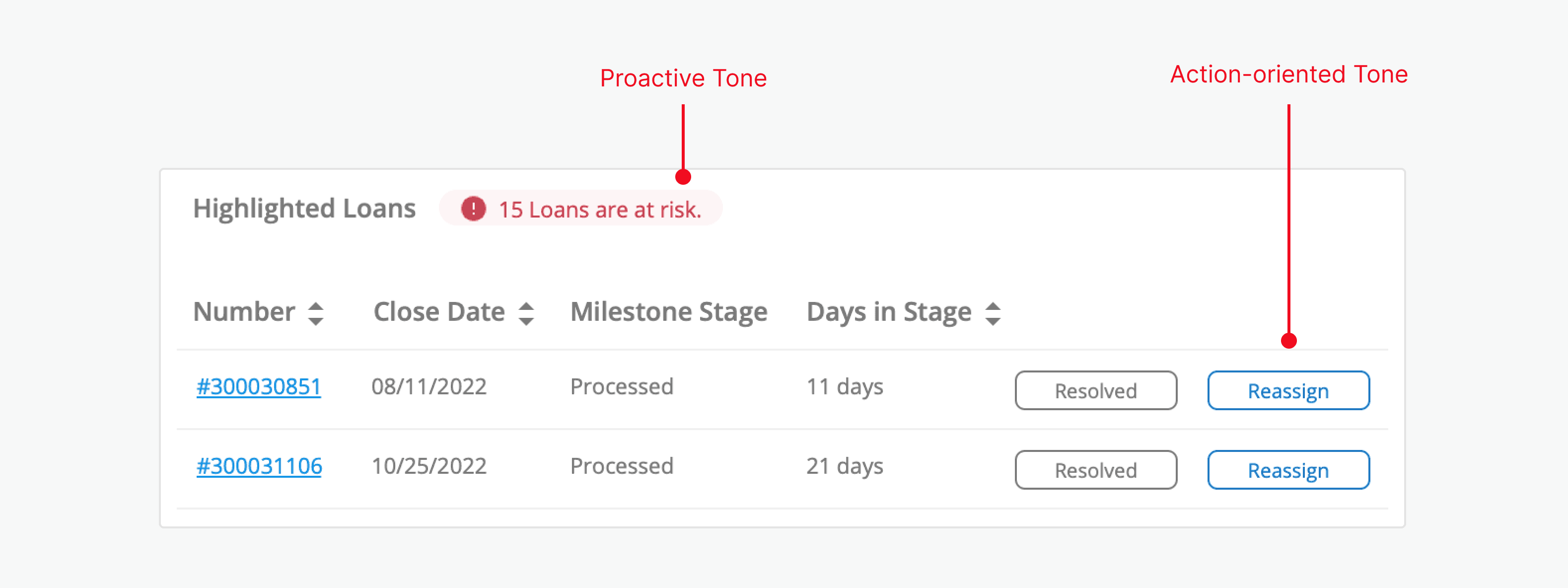

Brand Tone: Action-oriented, Proactive, and Formal

I defined the brand tone of the dashboard design as action-oriented, proactive, and formal. The tone of the dashboards conveys a formal and knowledgeable tone to assist officers' decision-making with transparent and solution-driven suggestions.

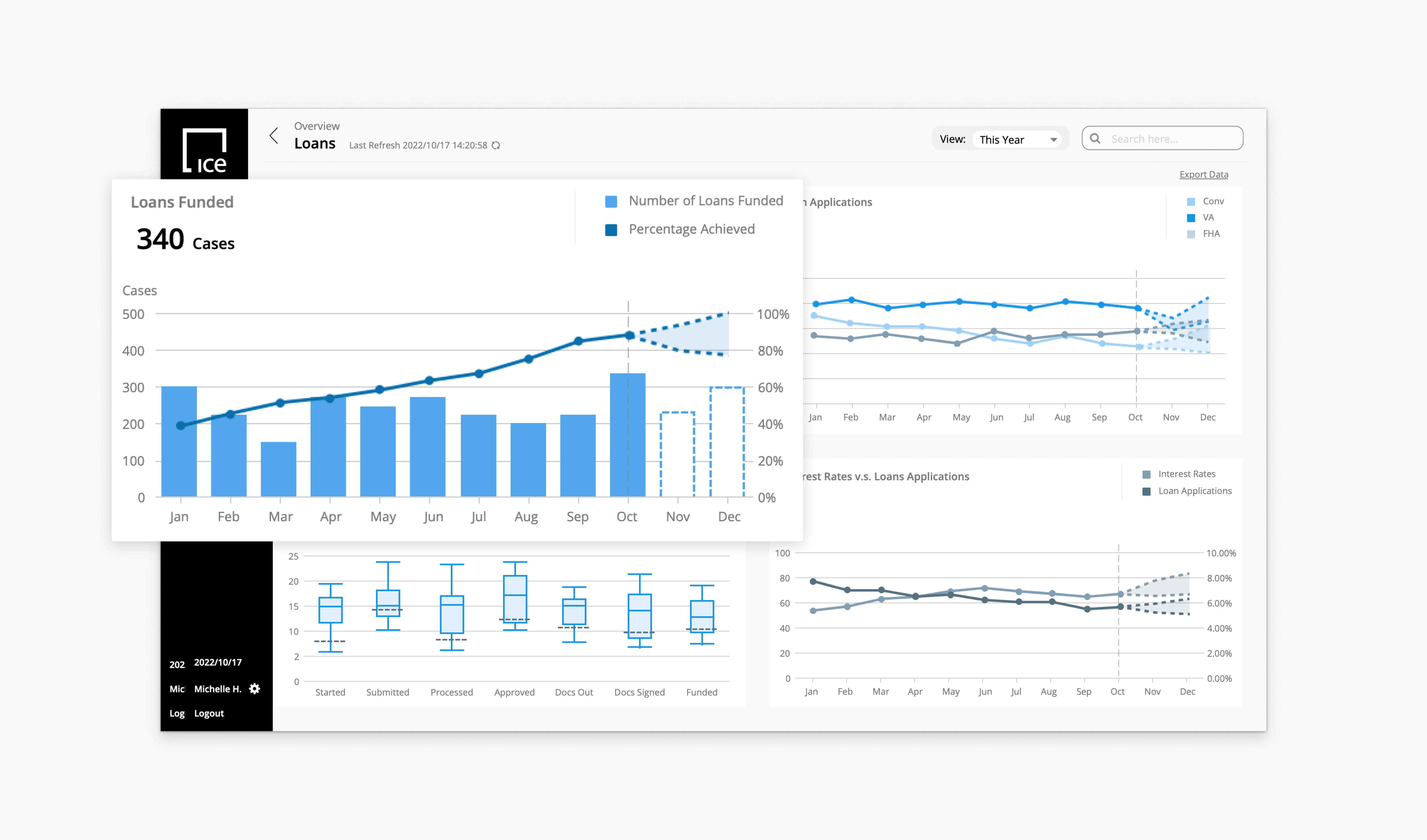

Deliverable: Manager

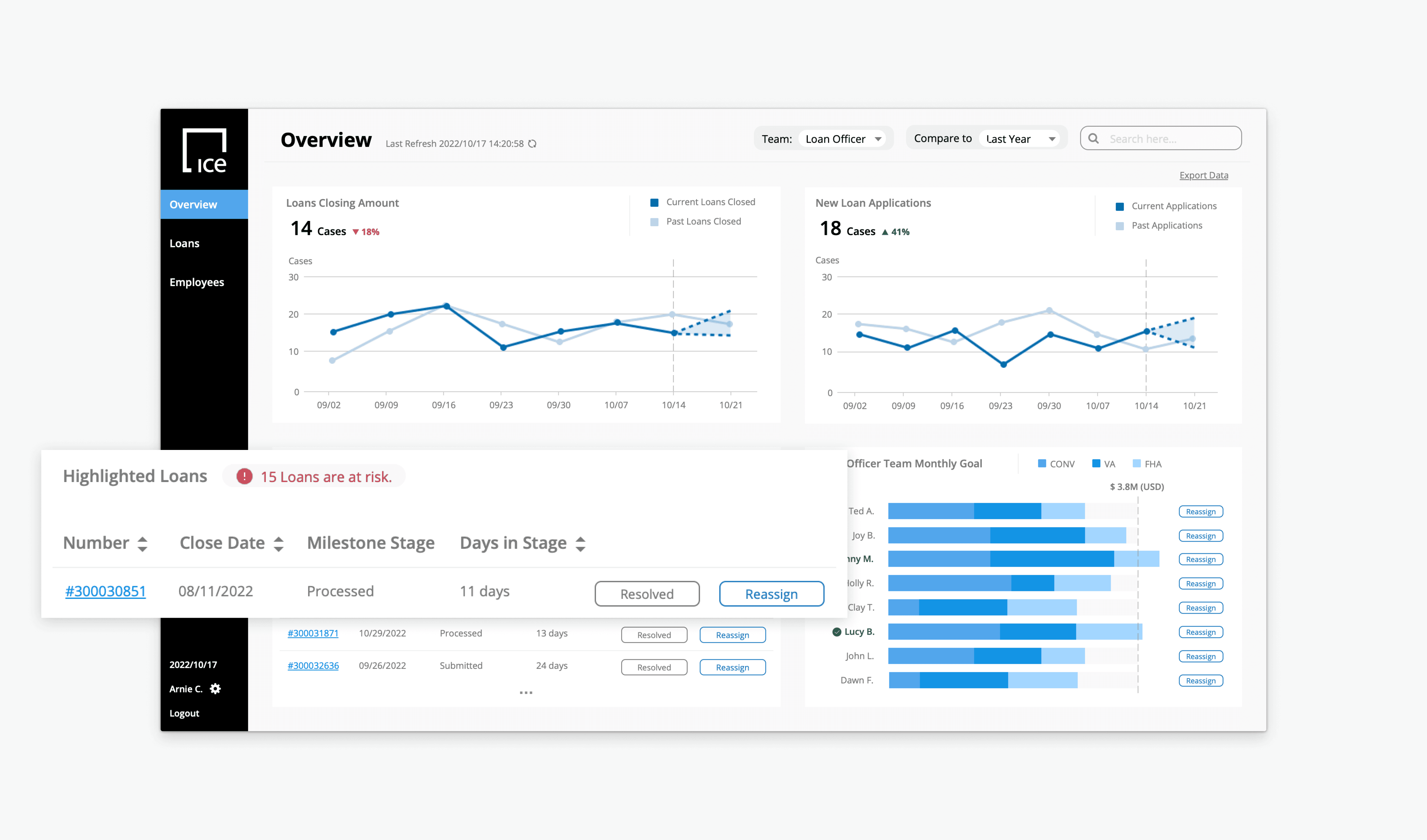

Dashboard Design: Manager

Managers focuses on re-distributing loans to employees

Managers face challenges in foreseeing factors causing delays and effectively allocating employees. The primary focus is on providing an overview of overall employee workload and detailed loan-blocking reasons, offering managers actionable insights.

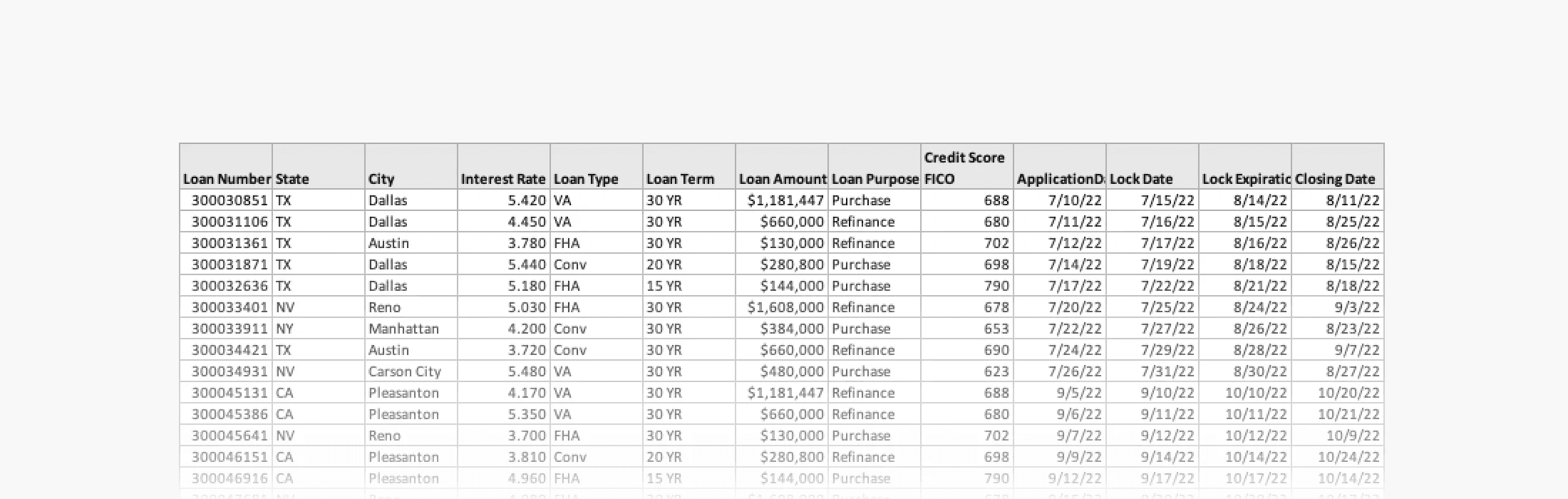

Highlight risk loans and prompted proactive measures to prevent bottlenecks

In the dashboard design, I converted Excel spreadsheet data, emphasizing potential high-risk loans ready for decisive action through clear, highlighted indicators.

Clear actions facilitating data comparison, allowing oversight of trends across different time periods

To visualized the comparison of data points across different time periods, I incorporated a dropdown at the top right of the dashboard for comparing different data trends.

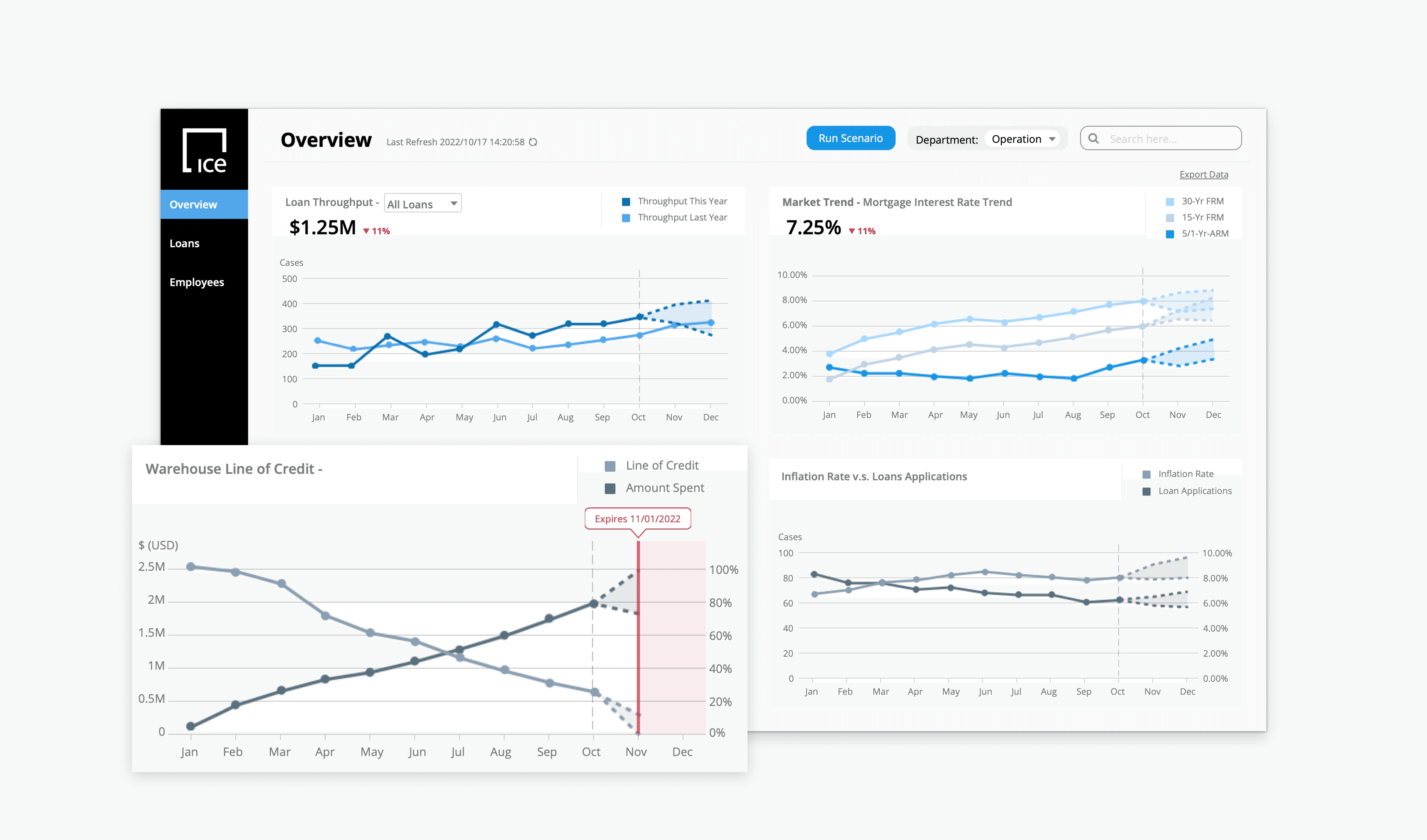

Deliverable: Executive

Dashboard Design: Executive

Prioritize tackling forecasting future trends for the strategic executive

The executives' primary needs involve effectively monitoring loan funding warehouse capacity and maximizing loan throughput.

Forecasting trends to ensure sufficient funds for processing committed loans

In the dashboard design for strategic executives, I prioritized analyzing future trends to ensure goal achievement.

Clear data visualization for future resource budgeting

Through micro-interactions, like hover for details, users can oversee potential risks and bottlenecks, and take actions proactively.

Takeaway

I learned to design solutions even in a unfamiliar domain…

As a designer, we sometimes have to cope with domains that we are not familiar with. This is a project in the mortgage industry, which was a great experience for me to get hands on experience in designing a new field.

The limitations.

Every project has limitation, due to the short time period working on my own, I had to compromised in order to deliver the final outcome on time. If I have more time on this work, I will put my design to usability test and comply my design with the WCAG guidelines to improve accessibility.